Facebook video shows contactless reader steal $30 from victim. Is it real?

A video claims to demonstrate how easy it is to steal money from those with contactless debit or credit cards using a wireless, contactless card reader.

The video shows a man with a wireless contactless reader going up behind another man and pressing the reader against his back pocket (where presumably the man’s wallet is located) which then authorises a sale of $30 (it appears to be filmed in either New Zealand or Australia.)

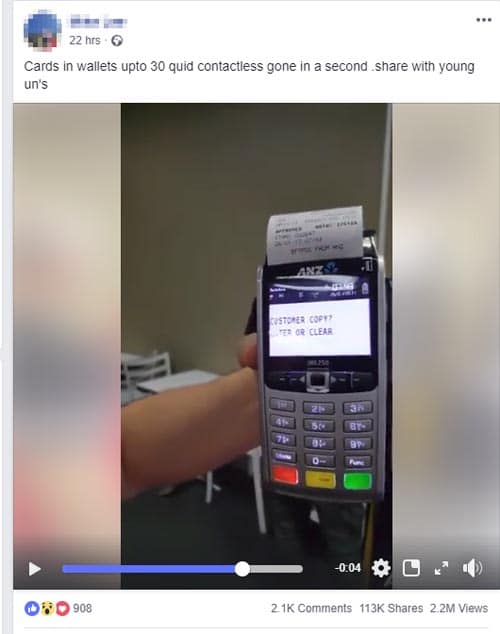

An example of the video on social media –

Cards in wallets upto 30 quid contactless gone in a second .share with young un’s

Contactless cards have become increasingly popular around the world where consumers press their card up against a contactless card reader to take the payment instead of typing their PIN code. There is a maximum amount per contactless transaction of around $30 depending on your country.

Is this type of crime possible?

Possible, yes. However it would be not be anywhere near as easy as this video implies. Would-be crooks may be disheartened to learn that stealing money this way isn’t as easy as going to the shop, buying a contactless reader and then go around pressing it against stranger’s pockets.

What would you need to steal money like this?

Firstly, to get a contactless card reader (or any card reader) to work, you need a Merchant ID (MID) account, which is needed to both authorise a payment and deposit it into your bank account. During an investigation in 2016 when we debunked a very similar rumour, we spoke to National Westminster Bank in the UK who stated that to obtain a Merchant ID number, you need to be a registered business, provide personal details about yourself and your business as well as undergo a credit check.

This is needed so payments can be tracked and monitored, which of course is used to – among other things – prevent fraudulent payments, such as the one demonstrated in the video. To commit such a crime, you would either provide legitimate details (and get caught very quickly) or provide false details and bank account details that don’t lead back to you (which is exceptionally difficult to do and not get caught!)

Sponsored Content. Continued below...

Secondly, a contactless reader doesn’t work unless it can contact a base unit which would need to be connected to a phone line, so it can transmit details of the payment to authorise it. This means this scheme wouldn’t work unless the contactless reader was being used within the immediate vicinity of the connected base unit.

Ultimately, this scheme would be difficult to operate, and exceptionally difficult to get away with.

As such, it’s not a particularly prolific type of crime, with only a handful of reported cases worldwide, and even these are disputed as to exactly how the money was taken from a bank account.

Sponsored Content. Continued below...

This doesn’t mean contactless cards don’t have issues

It is important not to conflate the alleged crime shown in the video with other types of crime related to contactless debit or credit cards.

Crime related to contactless cards is a real threat. Not only is having your contactless card stolen and used to pay for goods a genuine threat, but your card details can be “skimmed” by a card reader using easily obtainable software from the Internet.

This isn’t the same type of crime as demonstrated in the video, since such scams works by extracting and storing the information from the card, which could potentially be decoded and used to commit a crime at a later date (as opposed to making an on-the-spot transaction with a card reader as shown in the video.)

An investigation by Which? demonstrated that there are a number of scanning devices out there capable of reading the encrypted information from your contactless bank card chip when placed close enough to it. In some instances, according to Which?, they were able to extract enough data from some of the cards to make a payment with certain retailers.

However, while these scams are real, they are themselves still comparatively rare.

Ultimately though, the scheme as shown in the video spreading on social media omits important information about how difficult such a scam would be in the real world.

Continued below...

Thanks for reading, we hope this article helped, but before you leave us for greener pastures, please help us out.

We're hoping to be totally ad-free by 2025 - after all, no one likes online adverts, and all they do is get in the way and slow everything down. But of course we still have fees and costs to pay, so please, please consider becoming a Facebook supporter! It costs only 0.99p (~$1.30) a month (you can stop at any time) and ensures we can still keep posting Cybersecurity themed content to help keep our communities safe and scam-free. You can subscribe here

Remember, we're active on social media - so follow us on Facebook, Bluesky, Instagram and X