Here are the most popular HMRC scams you’ll see during tax season

If you receive emails, texts or phone calls claiming to come from the UK’s tax entity – the HMRC – there is a good chance that you are being targeted by cybercrooks.

Over the years, crooks have come up with a number of different HMRC-themed scams, and they’re always popular during the first four months of the year when two important tax dates in the UK come knocking.

We take a look at some of the popular scams that you’ll most likely come across.

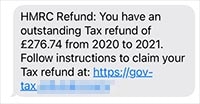

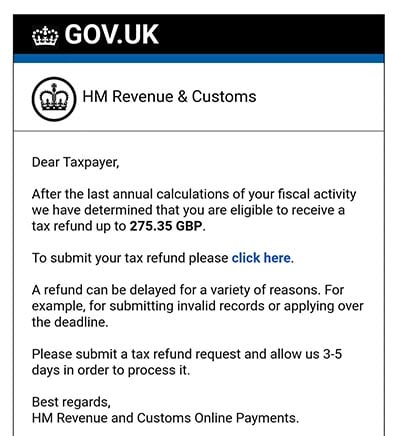

HMRC Refund Scam

Tax refund scams are perhaps the most common type of tax-themed scam, and can arrived via email or text message.

The scam here is simple. An unsolicited text or email will arrive claiming to be from the HMRC, and it will tell the recipient they are due a tax refund or rebate and ask you to click a link to get hold of it.

Here is a text example of this scam.

Here is an email example of this scam.

During the COVID pandemic, many of these scams claim the recipient is due a COVID-19 rebate instead. Some versions of this scam be initiated over the phone instead.

The link will direct the recipient to a spoof phishing website owned by scammers but made to look like the HMRC government website. Any information entered into it – such as your login details and sensitive personal information – is then captured by the scammers.

Learn more on how to spot a spoofed web address so you’ll always know when you’re being scammed here.

Tip: The HMRC will never text or email you about money owed or rebates. They will send you a letter through the post called a P800, or you can see by logging into your HMRC account online.

Sponsored Content. Continued below...

HMRC Arrest Warrant Scam

One of the most popular HMRC themed scams is the arrest warrant scam, whereby the victim will receive an unsolicited phone call claiming to be from someone at the HMRC (or the authorities) threatening you with arrest unless you immediately pay outstanding fines.

Often the phone call will play an automated message urging the recipient to press a number or dial another phone number, but in some cases a real person may be on the other end of the line.

The scam attempts to panic victims into making payments over the phone or giving away their financial information to crooks.

Tip: The HMRC will never call you, email you or text you to threaten you with arrest or with fines. They may call you to discuss outstanding payments a person will already be aware of. Any fines or penalties a person owes will initially be explained through letters.

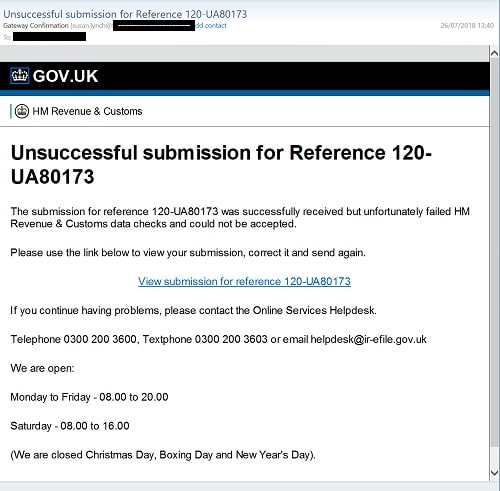

Unsuccessful Submission HMRC Scams

For those that file their own HMRC tax return, such as the self-employed, this scam will attempt to target them by claiming their tax file return was not successful.

An example of such an email can be seen below.

Such scams will claim there has been some type of issue with a tax submission and will urge the recipient to click a link to resubmit. This link will lead to a malicious website that will steal details or attempt to download malware.

Sponsored Content. Continued below...

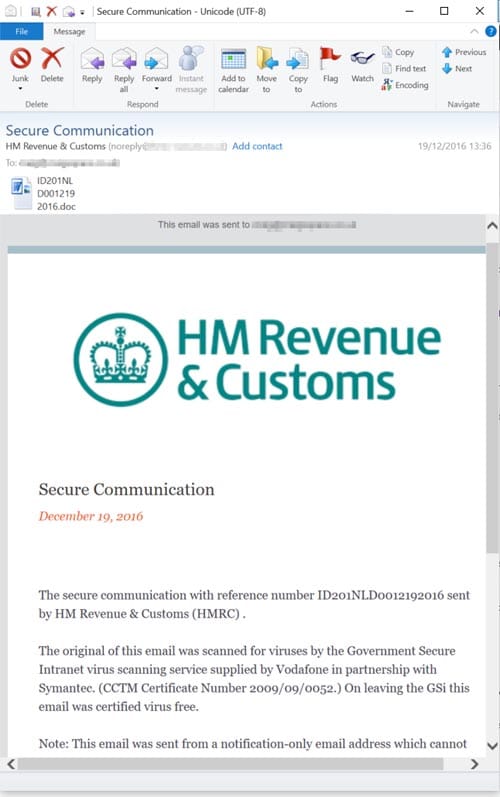

“Important HMRC Document Attached” Malware Scam

These scams that are typically initiated via email will appear to come from the HMRC and will claim that there are important HMRC documents attached to the email itself.

Such scams can vary widely in their wording, but will urge the email recipient to open an email attachment containing important tax related information. For example this could be a copy of your tax return, details as to why a return was unsuccessful, information about a rebate or fine, or a submission receipt.

The example below claims to have a “secure communication” from the HMRC attached.

The attachment was actually a Macro-booby trapped Word file that initiates a malware download to the recipient’s computer. (Learn more about them here.)

Tip: The HMRC will never send you emails containing attachments. If you ever receive one, it will be a scam. Never open email attachments from emails you were not expecting.

Continued below...

Thanks for reading, we hope this article helped, but before you leave us for greener pastures, please help us out.

We're hoping to be totally ad-free by 2025 - after all, no one likes online adverts, and all they do is get in the way and slow everything down. But of course we still have fees and costs to pay, so please, please consider becoming a Facebook supporter! It costs only 0.99p (~$1.30) a month (you can stop at any time) and ensures we can still keep posting Cybersecurity themed content to help keep our communities safe and scam-free. You can subscribe here

Remember, we're active on social media - so follow us on Facebook, Bluesky, Instagram and X